Revenue vs Retained Earnings: What’s the Difference?

The beginning period retained earnings are thus the retained earnings of the previous year. Now, you must remember that stock dividends do not result in the outflow of cash. In fact, what the company gives to its shareholders is an increased number of shares. Accordingly, each shareholder has additional shares after the stock dividends are declared, but his stake remains the same. Cash dividends result in an outflow of cash and are paid on a per-share basis.

What Is a Balance Sheet? Definition, Contents & Example – TheStreet

What Is a Balance Sheet? Definition, Contents & Example.

Posted: Fri, 28 Jul 2023 07:00:00 GMT [source]

A big retained earnings balance means a company is in good financial standing. Instead, they use retained earnings to invest more in their business growth. Retained earnings refer to the cumulative positive net income of a company after it accounts for dividends. You may use these earnings to further invest in the company or buy new equipment.

Everything You Need To Master Financial Modeling

That is, each shareholder now holds an additional number of shares of the company. The disadvantage of retained earnings is that the retained earnings figure alone doesn’t provide any material information about the company. In fact, both management and the investors would want to retain earnings if they are aware that the company has profitable investment opportunities. And, retaining profits would result in higher returns as compared to dividend payouts. If a company has negative retained earnings, it has accumulated deficit, which means a company has more debt than earned profits.

Retained earnings represent the portion of the net income of your company that remains after dividends have been paid to your shareholders. That is the amount of residual net income that is not distributed as dividends but is reinvested or ‘ploughed back’ into the company. At the end of the period, you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period, adding any net income or net loss, and subtracting any dividends. Any item that impacts net income (or net loss) will impact the retained earnings. Such items include sales revenue, cost of goods sold (COGS), depreciation, and necessary operating expenses.

Factors that can influence a company’s retained earnings

The decision to retain the earnings or to distribute them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company. However, company retained earnings represents owners can use them to buy new assets like equipment or inventory. The ultimate goal as a small business owner is to make sure you accumulate these funds. You can use them to further develop your business, pay future dividends, cover any debt, and more.

- Net profit is the profit a company has left over after all the variable costs, fixed costs and taxes have been paid.

- If you decide to reduce debt, you should prioritize which debts you’ll pay off.

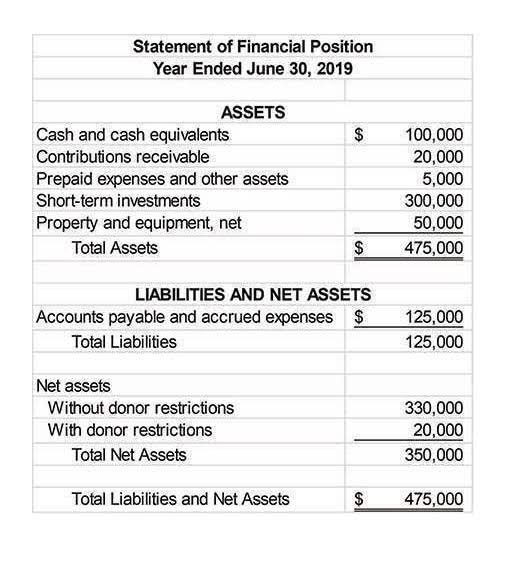

- Conversely, when total liabilities are greater than total assets, stockholders have a negative stockholders’ equity (negative book value) — also sometimes called stockholders’ deficit.

- On the balance sheet, the retained earnings value can fluctuate from accumulation or use over many quarters or years.

- However, after the stock dividend, the market value per share reduces to $18.18 ($2Million/110,000).

Some companies use their retained earnings to repurchase shares of stock from shareholders. You might go this route for various reasons, such as increasing existing shareholders’ ownership stake or reducing the number of outstanding shares. If you use retained earnings for expansion, you’ll need to determine a budget and stick to it. Doing so will ensure that your company uses its earnings efficiently and maintains the right balance between growth and profitability. On the balance sheet, the “Retained Earnings” line item can be found within the shareholders’ equity section. The discretionary decision by management to not distribute payments to shareholders can signal the need for capital reinvestment(s) to sustain existing growth or to fund expansion plans on the horizon.

What Are Retained Earnings? Formula, Examples and More.

It’s important to calculate retained earnings at the end of every accounting period. Finally, calculate the amount of retained earnings for the period by adding net income and subtracting the amount of dividends paid out. The ending retained earnings balance is the amount posted to the retained earnings on the current year’s balance sheet. At the end of that period, the net income (or net loss) at that point is transferred from the Profit and Loss Account to the retained earnings account.